What is the Typical Pay Mix for a TSX Mid-Cap Executive?

Executive Compensation Trends in the TSX Mid-Cap

Compensation Governance Partners aims to provide you with up-to-date executive compensation information and trends, via our proprietary compensation database (composed of fully evaluated and sized named executives from publicly-traded organizations).

In this 5-part series, we share our findings on executive compensation trends for companies ranked 100th to 200th within the S&P/TSX Composite Index using key statistics from the 2018 proxy season. As the 2019 proxy season progresses, we will update this series with commentary on year-over-year trends.

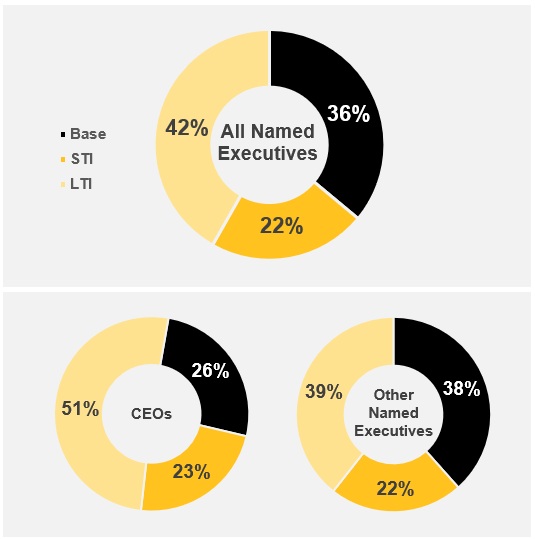

How is an executive of a publicly-traded company paid? What makes up a typical compensation package for an executive? For the average Canadian executive of a TSX mid-cap company, incentive compensation makes up the majority of their total compensation package. We explore the pay mix of the top 5 paid executives from 100 TSX mid-cap organizations in more detail below. Note that we define pay mix as the ratio of compensation representing base salary, short-term incentives (STI) and long-term incentives (LTI).

“Only 36% of target total direct compensation for a TSX mid-cap executive is made up of base salary.”

Incentive compensation (also known as “variable compensation” or “pay-at-risk”) represents compensation outside of base salary (“fixed compensation”). This type of compensation is typically tied to performance and can be broken down into:

Short-term incentives: Payment for performance over a one year period, usually paid in cash

Long-term incentives: Payment for performance over a period of longer than one year, usually granted in the form of stock options, PSUs and/or RSUs

In general, the purpose of executive incentive compensation is to tie pay to the performance of the organization. Only 36% of target total direct compensation for a TSX mid-cap executive is made up of base salary. Incentive compensation (target STI and LTI grants) takes up the remaining 64%.

LTI makes up most of the average Canadian mid-market executive’s incentive pay, with a greater % of total compensation assigned to LTI for more senior positions, typically reflecting the more strategic role of top executives. As the head of the organization, the average TSX mid-cap CEO receives 51% of their overall compensation in LTI, compared to 39% for other named executives.

Figure 1: Target pay mix within the Canadian mid-market (TSX Mid-Cap)

Authors

Eddington Ruiz, Associate

→ eruiz@compgovpartners.com

Marlene Georges, Principal

→ mgeorges@compgovpartners.com