Stock Options in Canada: Are They Still Right for Your Executives?

UPDATE: On June 17, 2019, the Federal government released a Notice of Ways and Means Motion to amend the Income Tax Act to accommodate the planned taxation rules for stock options.

The motion includes amendments that state (among other details): Canadian-controlled private corporations (CCPCs) are exempt from the new limit; employers now have the ability to designate otherwise tax-exempt options as “non-qualified” and taxable at ordinary rates; and how the limit is applied to options that vest over several years.

The contents of this article have been updated to reflect additional information from the motion.

UPDATE 2: On December 20, 2019, the Federal government released an update on the proposed changes to the stock option taxation rules, stating that the changes would be postponed and set as part of the 2020 budget.

(Modified December 20, 2019)

On March 19, the Federal government announced their planned budget for 2019, along with its intention to limit tax benefits related to employee stock options for “large, long-established, mature firms”, in an effort to align tax treatment with U.S. practices and address the growing amount of tax deductions claimed by executives and other high-income individuals.

What are the current taxation rules for stock options?

Currently, income from stock options of a publicly-traded organization are eligible for a 50% deduction of the taxable income amount (similar to the capital gains tax rate), provided that certain conditions are met.

Example:

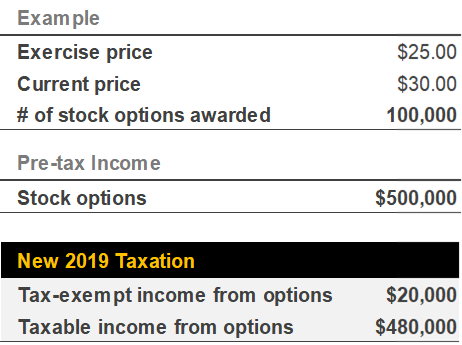

Kyle received 100,000 options 3 years ago with an exercise price of $25, all of which vest today. Today’s stock price is $30. If Kyle chooses to exercise his options and sell the resulting stock today, the monetary gain he receives upon exercise is ($30 - $25) x 100,000 = $500,000.

With the 50% deduction, the taxable income at ordinary rates from these options is $500,000 x 50% = $250,000.

What is the new limit on stock options?

According to the 2019 Budget, the government will apply a $200,000 annual cap on options that may receive tax-preferred treatment based on the fair market value of the underlying shares at the time of grant for employees of large, long-established mature firms.

What are the tax implications for impacted companies?

In our example of 100,000 options at an exercise price of $25, the 50% deduction only applies to $200,000 / $25 = 8,000 options under this new system, while the rest of the options are taxable at ordinary rates. This means that 8,000 x ($30 - $25) = $40,000 is eligible for the 50% deduction.

This now means that the tax-exempt income from these options is $40,000 x 50% = $20,000, while the taxable income at ordinary rates is the remaining $480,000.

In this scenario, $480,000 / $500,000 = 96% of the pre-tax income is taxable, as opposed to the current 50%.

How does this new limit complicate your compensation plans?

For compensation purposes, options are not valued purely based on the underlying share price – typically, methods such as the Black-Scholes model or the Binomial model are used to estimate a fair value for the option itself. In brief, these models account for the potential increase (or decrease) in the price of the underlying security during the life of the option. Effectively, long-term incentive (“LTI”) plans must award a larger number of options than shares to achieve the same fair value.

This new limit does not account for the fair value of the option itself, and thus executives will find that the real limit in terms of option fair value is much lower (i.e. if your option’s fair value is x% of the underlying stock’s fair value, your effective limit on the fair value of tax-preferred options is x% of $200,000).

Options have been viewed as a tax-advantageous method of compensation, but this new limit levels the playing field with share-based awards. Without the full 50% deduction, an executive’s preference for a specific LTI vehicle will come down to individual risk tolerance, and weighing the benefits of the highly leveraged upside of an option to the security of a share-based award.

We highly advise consulting your tax advisor regarding your individual tax calculation.

For illustrative purposes, here is an example where the new taxation rules could negatively impact the after-tax payout from your LTI plan. In this scenario, we will assume that the target dollar amount of your long-term incentives is $500,000, and compare the difference between the after-tax income from an option award and from an equivalent award of restricted share units (RSUs), which are simply taxed as ordinary income upon vesting:

At this point, we can see that stock options result in lower pre-tax income. However, there is a significant difference in after-tax income under the current taxation rules and the new taxation rules:

In this scenario, a previously-advantageous tax situation now becomes unfavourable once the new limit is applied.

Our Observations

What areas are yet to be addressed by the new legislation?

The definition of “large” and “mature” companies has not been clearly defined. According to the 2019 budget (Budget 2019, page 202), the changes will be guided by two key objectives:

To make the employee stock option tax regime fairer and more equitable for Canadians

To ensure that start-ups and emerging Canadian businesses that are creating jobs can continue to grow and expand

However, it is unclear if the exceptions to the $200,000 limit will be based on length of incorporation, market capitalization, revenues, or some permutation of these or other factors. The federal government is currently “seeking stakeholder input on the characteristics of companies that should be considered start-up, emerging, and scale-up companies for purposes of the prescribed conditions” until September 16, 2019.

The limit calculation favours executives in companies with lower stock prices, as it is only based on the fair value of the stock at the time of grant. If the fair value of the stock drops just before the options are issued, the tax-preferred treatment will apply to more options – as such, temporary dips in share price before grant may have a noticeable impact on the number of tax-preferred options.

It is currently unknown if or how the government intends to address this issue or other issues such as corporate actions (e.g. stock splits).

What might be the best replacement for stock options?

One potential replacement is performance-based share units (PSUs), which are full-value share-based awards with performance conditions attached that can affect the number of share units paid out to the executive. PSUs are taxed similar to RSUs and result in similar after-tax income (provided that the executive reaches their performance targets), in addition to being a good governance practice. PSUs are highly preferred by shareholders, proxy advisors (such as ISS and Glass Lewis) and the Canadian Coalition for Good Governance (CCGG) for their direct ties to corporate performance.

Will stock options become a rare sight among top TSX issuers?

While grants of stock options might be smaller and less common, they are unlikely to disappear completely from long-term incentive plans at larger companies. Organizations with a strong positive outlook on future growth may decide that their expected growth will outpace the loss of after-tax income and continue to issue options. Other organizations without easily-identified performance indicators may use options to act as a pseudo-performance requirement, as the payout of a stock option inherently requires share price growth.

How can we help?

While there has been no clear indication of which organizations fall under the definition of “large, long-established and mature”, you may wish to consider the implications of these new taxation rules on stock options for your organization and eligible employees prior to the legislation taking effect. Should stock options still play a major role in your approach to compensating your executive team?

Compensation Governance Partners specializes in executive compensation matters (including long-term incentive plan design), and we can help you determine the most appropriate course of action when it comes to your executive compensation plan. To learn more about how we can assist you, please contact us.

Authors

Eddington Ruiz, Associate

→ eruiz@compgovpartners.com

Marlene Georges, Principal

→ mgeorges@compgovpartners.com